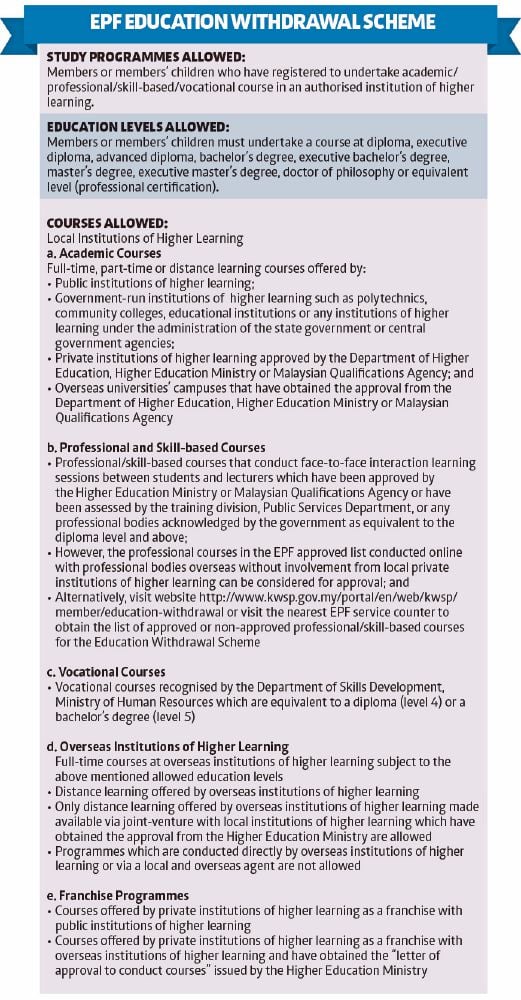

For more information on EPF Withdrawal Scheme for Education. Course recognition or accreditation letter.

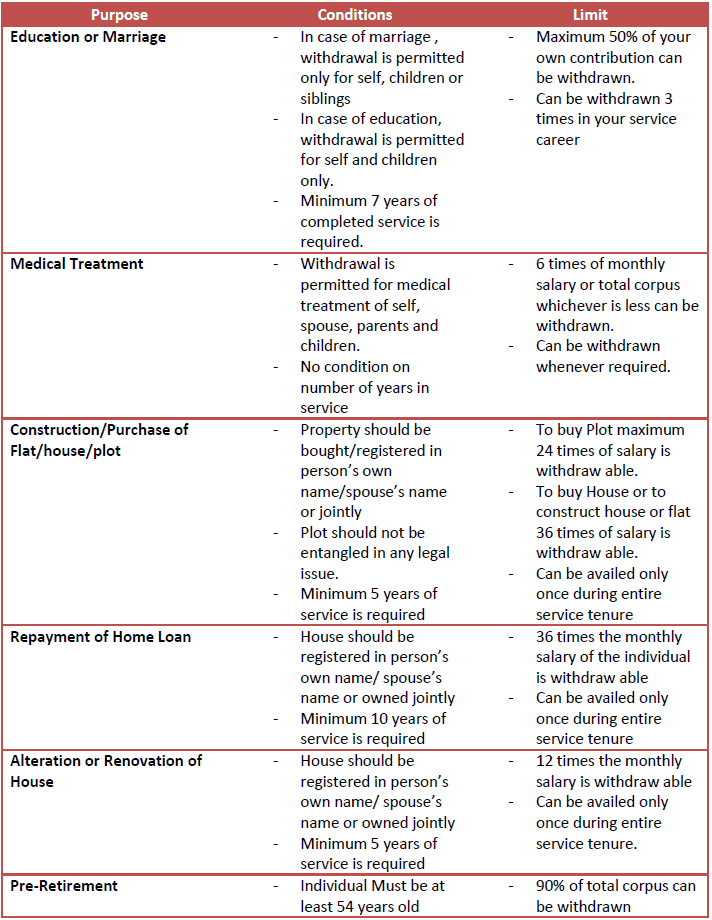

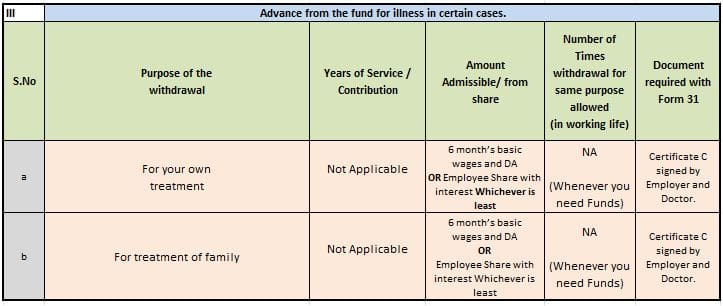

Epf Withdrawal Rules When And For What You May Withdraw Your Epf

While it is possible to withdraw the EPF corpus before retirement it is still advised that you do not do so.

. Surat pengesahan pendaftaran pelajar. So it is crucial to compile all the required documents to ensure a smooth application process. EPF withdrawal letter from Sunway University.

For more information please visit or call the nearest EPF office at. Salinan dokumen pengenalan bersama yang asal untuk tujuan pengesahan untuk bukan pemegang MyKad sahaja Surat kelulusan pengiktirafan kursus pengajian. Certification of Accreditation for the programme the student is taking need to be stamped and signed by Sunway University.

This income of Employee comes under 80C section of Income-tax act. Tertiary education is exceptionally expensive these days and while PTPTN has done a good job of assisting those who need help with paying for tuition fees it may be difficult to immediately repay your study loan in the years after you start working. Depending on the course you take the need for a post-malnutrition program will be necessary.

It is treated more like a withdrawal from the corpus that gets accumulated month-on-month and year-on-year. Withdrawal from Account 2 to fund own or childrens education. Employees Provident Fund Bangunan KWSP Jalan.

With that in mind the EPF allows you to. Thus youre eligible to withdraw. Check balance amount in EPFs Account II.

Step 1- Sign in to the UAN Member Portal with your UAN and Password. This is a unique loan as you dont need to return the same. If you meet this condition you can follow the procedure given below to withdraw your EPF online.

Before applying for withdrawal under this scheme EPF members are required to check the balance in Account II and obtain a letter from EPF that specifies the amount that can be withdrawn. Ad Single place to edit collaborate store search and audit PDF documents. Upon approval payments are made directly to the University.

There are many questions related to the EPF but the question that often arises for an employee is. Also you can withdraw your EPF money for any other professional course. 85 rate of interest is applicable to the EPF contribution for FY 2020-21.

It is possible to withdraw either 50 or all of the amount contributed and all accrued interest. Online EPF withdrawal requests can be settled within 15 to 20 working days from the date of submitting the request. Members can apply by completing the KWSP 9H AHL form and submit together with supporting documents.

7Additional documents required for withdrawal for Members or Members childrens education. This means the funds can be withdrawn for any course at a college or university for graduation and above. Interest rates are confirmed by them every year.

So the salary you receive on hand comes after the deduction of PF. Members can apply for this scheme by completing the KWSP 9H AHL form together with the relevant supporting documents. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

Borang KWSP 3 Pindaan untuk penghantaran melalui pospengesahan cop ibu jari gagal. It can be your sibling or brothersister. 8 The required supporting documents may vary for the 1st and 2nd withdrawal.

Yet its applicable in the case of higher education only. Step 2- From the top menu bar click on the Online Services tab and select Claim Form-31 1910C 10D from the drop-down menu. Introduced in 2013 the e-Pengeluaran facility started with limited housing withdrawals.

For the previous financial year 2020-2021 the interest rate is 85 In the fiscal year 2019-2020 the interest was 865. This is because early withdrawals from the EPF are not a part of the tax-deductible income of the employees. 2021 Union Budget Update.

You can even take a loan against your employees provident fund EPF for the education of your kids. Your son daughter sibling or yourself can make the withdrawal for their education. What is the Withdrawal Limit of Do You Withdraw from EPF for Education.

Borang KWSP 9H AHL dan Senarai Semak Dokumen. 1 day agoThe Employees Provident Fund is essential for every employee and helps build a retirement corpus. PF Withdrawal Rules 2022.

This rate always remains higher than PPF or any fixed-income funds. It means if youre getting your daughter admitted to a college and you need money for her college fees. In case the PF contribution of the employees was deducted but the employer did not deposit it to the EPF contribution then the amount will not be allowed as a deduction for the employer.

Obtain the supporting documents from the Sunway University respective Faculty administration office-. Another condition that needs to fulfilled before applying for withdrawal is that you have to complete seven years as EPFO member. Upload Edit Sign PDF Documents from any device.

If you are an Employees Provident Fund EPF contributor and plan on using your EPF funds to finance your own or your childrens education at local higher learning institutions HEIs you can now submit your withdrawal applications online using e-Pengeluaran. EPF Withdrawal for Education Including PTPTN. You can also withdraw your EPF amount for educational purposes.

Letter for EPF withdrawal from the university.

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Epf Partial Withdrawal Or Advance Process Form How Much

0 Comments